The National Treasury has announced a new plan to change how the government manages money, starting in July. The goal is to make government spending more efficient, reduce corruption, and improve how services are delivered to the public.

This plan, called the Treasury Single Account (TSA), will bring all government funds into one central system, making it easier to track how money is used and where it goes.

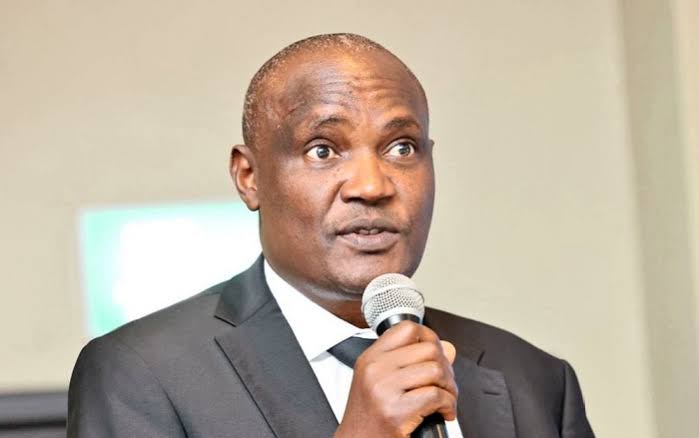

According to Treasury Principal Secretary Chris Kiptoo, these changes will help the government tighten control, make better financial decisions, and ensure that services reach the people as intended.

Everything will be done through a digital system that keeps clear records and helps avoid errors or fraud.

Another new feature is something called Invoice Twinning. This means that when a supplier sends an invoice for payment, it will be directly connected to the exchequer system, which handles government payments. This connection will stop people from cancelling payments without permission or paying only selected invoices unfairly.

The national government will use this system first, and once the counties have fully automated their payment systems, they will also start using Invoice Twinning.The Treasury is also introducing a Just-In-Time disbursement model.

Under this model, money will only be released when there is a real, confirmed need for payment. This will help manage the government’s cash better and reduce the need for borrowing.

Another benefit of the TSA is that it will help track how much money state-owned companies have at all times. This will make it easier for officials to plan and manage funds, prevent misuse, and improve financial discipline.

With this new level of visibility, government leaders will be in a better position to make smart choices about spending and saving.To make all these reforms possible, the Treasury is working closely with the Central Bank of Kenya. The Central Bank is upgrading its T24 Core Banking System to a new version that will support these changes. The announcement was made during a meeting at the National Treasury offices, where top officials from different financial institutions came together to discuss how to move forward.

Many countries around the world use a similar system to make sure government money is used properly. With these reforms, Kenya is taking an important step towards better financial management, improved service delivery, and stronger accountability.

One big change is that payments, including Kenya’s debt payments to both local and foreign lenders, will be handled automatically. This means the government will no longer rely on manual processes that can lead to mistakes or delays.

Leave feedback about this