The KUSCCO fraud is not just a simple theft but a carefully orchestrated scam that lasted for over a decade, costing thousands of Kenyans their hard-earned savings.

The Kenya Union of Savings and Credit Cooperatives (KUSCCO), which was supposed to safeguard millions of SACCO members’ funds, was instead turned into a playground for looters led by former CEO George Ototo and former Chairperson George Magutu among others.

Together, they allegedly misappropriated over Ksh 13 billion through a web of corrupt deals, failed real estate projects, and fraudulent lending.

The scale of this fraud was so vast that even government officials tasked with oversight were compromised. According to investigations, several Cabinet Secretaries responsible for cooperatives were bribed to ignore the rampant mismanagement, allowing the theft to continue unchecked.

It was only after Simon Chelugui took office as Cooperatives CS and refused to cooperate with these corrupt schemes that the fraud was finally exposed.

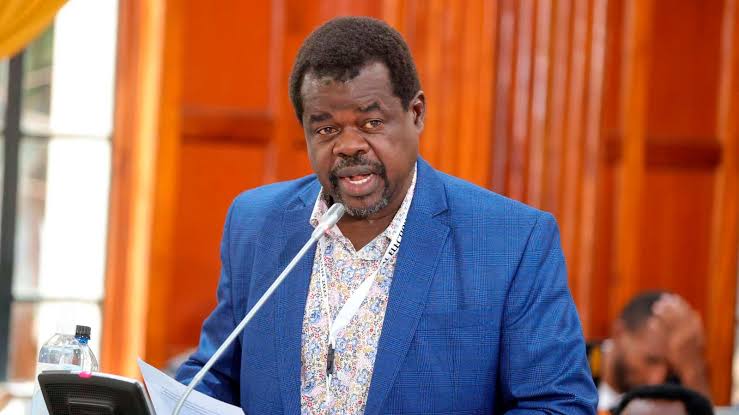

Senator Okiya Omtatah has been a leading voice demanding accountability. He pressed the Ministry of Cooperatives to provide a full report after countless complaints from SACCO members who could no longer access their deposits or receive dividends. The ministry’s response revealed that KUSCCO still owes members approximately Ksh 12.4 billion in undischarged deposits, with the total losses estimated at Ksh 13.3 billion.

Key suspects at the center of this scandal include George Ototo, who took out suspicious loans amounting to over Ksh 105 million, Kenneth Odhiambo with Ksh 17 million, Wilfred Aidima, Alfred Milowa, David Oyiega, and Andrew Orwach.

These senior officials were dismissed after investigations revealed irregularities in their loan portfolios and direct involvement in the misuse of funds.

The Principal Director, Finance Manager, and Advocacy Manager at KUSCCO are also implicated, with ongoing investigations by the Directorate of Criminal Investigations.

This massive fraud has had a devastating effect on ordinary Kenyans. Thousands depended on their SACCO savings for school fees, medical bills, and retirement. With the collapse of KUSCCO’s credibility and financial stability, many members are now facing dividend cuts and limited access to their money.

Omtatah emphasized that this is not just about numbers but about real lives destroyed “livelihoods lost, school fees held up, retirement plans destroyed, hospital bills unpaid.”

Despite the serious nature of these allegations, the accused suspects managed to secure bail with a mere Ksh 3 million bond, a small sum compared to the billions stolen. This has raised questions about the effectiveness of Kenya’s justice system when it comes to prosecuting high-level financial crimes.

The ongoing court proceedings aim to recover the stolen funds and ensure those responsible are held accountable, but public trust remains fragile.

Leave feedback about this