The Kenya Revenue Authority (KRA) has been under heavy scrutiny for its treatment of taxpayers.

While Kenyan businesses struggle under the weight of aggressive tax collection, foreign companies, particularly Chinese ones like Tecno, appear to evade taxes with little consequence.

This double standard raises serious concerns about the fairness and transparency of Kenya’s tax system.

Tecno, a Chinese-owned company, has reportedly evaded over Ksh. 400 billion in taxes.

Last year, social media pressure prompted KRA to raid Tecno’s offices at Cardinal Otunga Plaza to investigate these allegations.

However, no conclusive statements followed the raid, leaving many Kenyans suspicious.

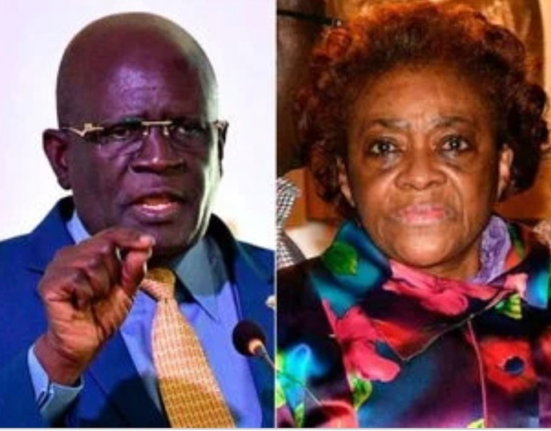

Credible reports later surfaced, claiming that Tecno paid Ksh. 100 million to KRA Commissioner General Humphrey Wattanga to halt further investigations.

This alleged bribery has gone unanswered, further fueling public distrust in the tax authority.

Several questions remain unanswered.

For instance, how much does Tecno pay in taxes? Unlike other companies such as Safaricom, EABL, and Twiga Foods, whose tax contributions are public knowledge, Tecno’s tax records are shrouded in secrecy.

This lack of transparency raises eyebrows, particularly when companies like Twiga Foods, with comparatively smaller operations, pay more taxes than Tecno, which reportedly spends over Ksh. 3 billion annually on marketing alone.

Additionally, why does Tecno pay its employees in cash? Such practices often point to tax evasion and other financial irregularities.

Furthermore, KRA officials reportedly visit Tecno offices weekly to collect money privately, which, if true, highlights a deeply entrenched culture of corruption within the tax system.

The issue is not isolated to Tecno.

Many Chinese companies in Kenya allegedly register under one entity but use the license to operate multiple businesses without paying appropriate taxes.

Opera, through proxy companies like Okash, is cited as another example of foreign firms benefiting from lax enforcement while avoiding their tax obligations.

While KRA aggressively pursues struggling Kenyan businesses and individuals for tax compliance, foreign companies appear to operate with impunity.

This selective enforcement not only stifles local businesses but also creates an uneven playing field.

It undermines trust in KRA and raises questions about the institution’s commitment to fair and transparent tax administration.KRA owes Kenyans answers.

It must disclose how much Tecno has been paying in taxes and address allegations of corruption within its ranks.

Sweeping these issues under the rug while targeting Kenyans like Morara only serves to deepen public frustration.

The government and KRA must prioritize fairness and hold all companies, local and foreign, equally accountable for their tax responsibilities.

Leave feedback about this