Willy Abuga recently took to X to expose the harsh reality of Safaricom’s Ziidi Money Market Fund (MMF), calling it a lie with no tangible interest or earning.

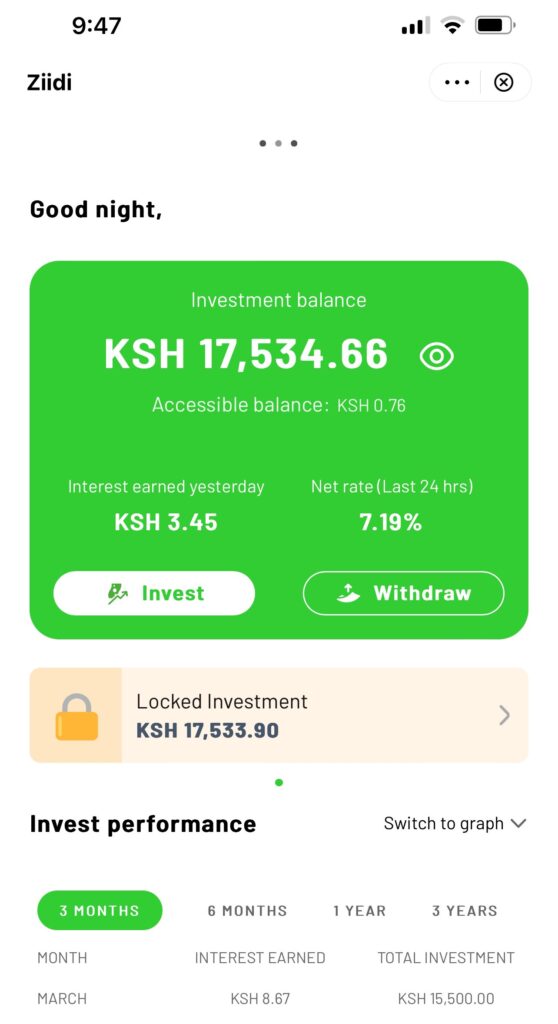

He revealed that since January, he had only made KES 34 in interest, proving that this so-called investment option is nothing more than a marketing gimmick designed to lure unsuspecting Kenyans into thinking they are growing their money.

The frustration in his post reflects what many others are experiencing—Safaricom hyped Ziidi as a revolutionary investment tool, but in reality, it delivers little to no benefit to its users.

This is yet another example of Safaricom using its dominance to exploit the masses while offering nothing of real value.

When Safaricom launched Ziidi, they marketed it as an easy and accessible way for Kenyans to invest and earn interest on their savings. They claimed that users could start with as little as KES 100, with daily interest accruals and the ability to withdraw funds at any time via M-PESA.

On paper, it seemed like a great initiative, but now that the dust has settled, users are realizing that it was all just clever advertising.

The returns are disappointingly low, and the hidden fees eat into whatever little interest one might earn. What is the point of investing in a fund that gives you peanuts in return? Safaricom is simply taking advantage of people’s trust and lack of financial knowledge to push a product that does not work.

Ziidi is supposedly managed by Standard Investment Bank and ALA Capital Limited under the regulation of the Capital Markets Authority (CMA), but even with these big names attached, the fund is proving to be nothing more than a trap.

The concept of a Money Market Fund (MMF) is to invest in low-risk, short-term financial instruments like government securities and fixed deposits, which should generate steady but reasonable returns.

However, in the case of Ziidi, the returns are so low that it is not worth the trouble. Add to that the 2% annual fund management fee and the 15% withholding tax, and it becomes clear that investors are left with almost nothing. Safaricom and its partners are the only ones benefiting from this so-called investment.

This is not the first time Safaricom has messed up when dealing with financial services. Before Ziidi, they had Mali, another MMF that was supposed to help Kenyans grow their savings.

However, the transition from Mali to Ziidi was a chaotic mess. Some users were automatically migrated without proper communication, while others were left stranded when Mali suddenly stopped functioning.

Even now, people are still unsure about what happened to their Mali investments. This lack of transparency and the constant shifting of goalposts show that Safaricom is only interested in pushing its agenda, not in genuinely helping Kenyans secure their financial future.

The reality is that Ziidi is not a serious investment option. It is a tool for Safaricom to keep users engaged within their ecosystem while collecting fees and commissions from unsuspecting customers.

If a product truly worked, people like Willy Abuga wouldn’t be complaining about earning KES 34 after months of investing. The fact that so many users feel cheated is proof that Ziidi is a failure. Safaricom has mastered the art of creating hype around its products, but when it comes to actual results, they always fall short.

If Safaricom really cared about empowering Kenyans financially, they would ensure that their MMF provided reasonable returns and clear information on how interest is calculated.

Instead, they rely on their massive influence to push substandard financial products, knowing that most people won’t question them.

Kenyans need to wake up and realize that Safaricom is not their friend. It is a business that prioritizes profits over people, and Ziidi is just another scheme to keep them hooked while giving them nothing in return.

The sooner people understand this, the sooner they can stop falling for these empty promises and look for real investment opportunities elsewhere.