Equity Bank is once again in the spotlight for all the wrong reasons. A concerned customer has raised serious allegations about suspicious activities linked to the bank, exposing what seems to be a well-organized scheme to defraud customers.

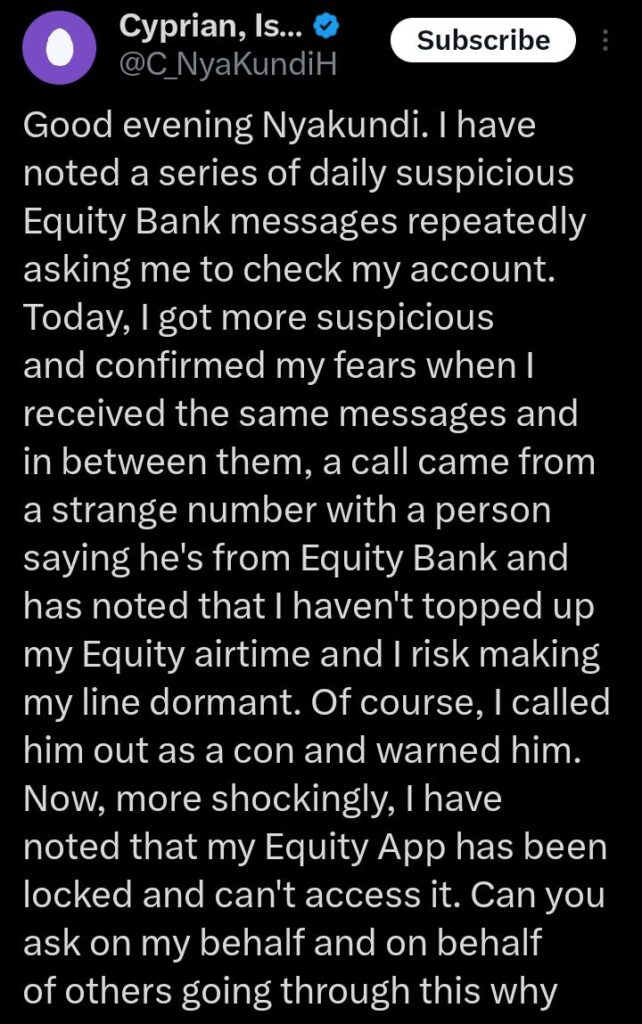

The revelations, shared by Cyprian Is Nyakundi, paint a disturbing picture of a bank that appears to be either complicit or negligent in protecting its clients.

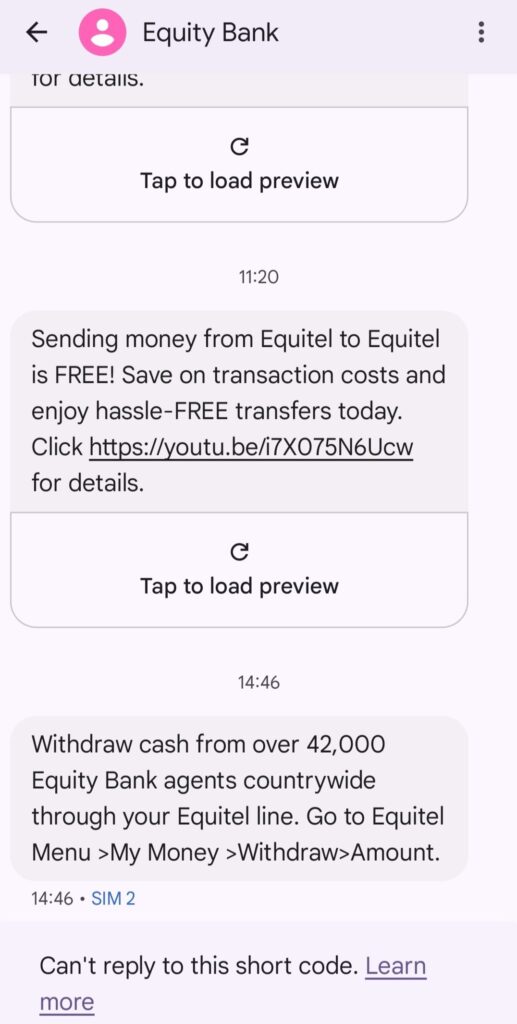

According to the whistleblower, they have been receiving numerous messages from Equity Bank urging them to check their account.

While this may seem normal at first, things took a sinister turn when, in between the messages, they received a call from a strange number.

The caller, claiming to be from Equity Bank, warned them that failing to top up their Equity airtime would lead to their line becoming dormant.

This immediately raised red flags for the customer, who saw through the scam and confronted the caller.

However, what happened next was even more alarming their Equity app was mysteriously locked, blocking their access to their own account.

These incidents suggest a deep-rooted problem within Equity Bank. The fact that the scam messages were official Equity Bank alerts means that someone within the bank has access to customer data and is misusing it for fraudulent purposes.

If this was an isolated case, it could be dismissed as a random cybercrime attempt. However, multiple customers have come forward with similar complaints, exposing a pattern of organized fraud linked to the bank’s internal systems.

Cyprian Is Nyakundi has been at the forefront of exposing corporate scandals, and this latest exposé is no different. The big question now is: Why has Equity Bank failed to act? With the technology and resources at their disposal, the bank can easily trace the origins of these fraudulent messages and calls.

But instead, they remain silent, allowing customers to be harassed and potentially defrauded. It raises suspicions about whether some insiders within the bank are working with fraudsters to exploit customers.

Equity Bank has long marketed itself as a bank for the common person, but cases like these prove otherwise. Instead of protecting its customers, it seems to be enabling criminal activities, either through direct involvement or gross negligence.

The fact that people’s banking apps can suddenly be locked after confronting scammers suggests a deliberate attempt to silence those who question the fraudulent activities.

Customers should also demand accountability, and whistleblowers like Cyprian Is Nyakundi must continue exposing these dirty dealings before more people fall victim to what now appears to be a well-coordinated fraud operation within the bank.

Leave feedback about this