The National Treasury is once again on the spotlight after a new audit report revealed that Ksh160 billion in debt repayments remains unaccounted for.

This comes at a time when the government plans to borrow an additional ksh413 billion in the current financial year, raising serious concerns about transparency and accountability in handling public funds.

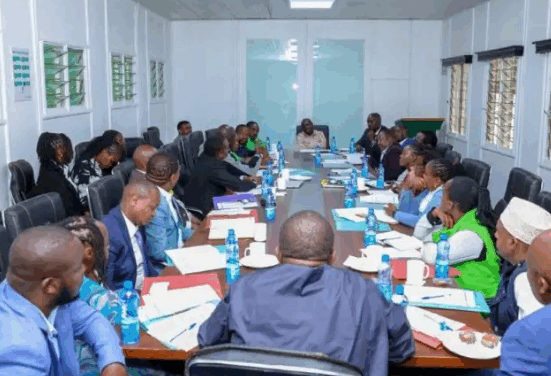

The report, prepared by Auditor General Nancy Gathungu, was presented to the National Assembly’s Public Debt and Privatization Claims Committee, exposing major discrepancies in debt repayments between 2020 and 2023.

The audit found that the Treasury had exceeded the legally allowed deviation limit of 5%, with some variances reaching up to 10%.

One of the most shocking findings was the underpayment of Ksh83.3 billion in 2022 alone. Such massive discrepancies have raised fears that a significant portion of public debt could be tied to corruption and mismanagement.

MPs expressed concern over these irregularities, with Baringo North MP Joseph Makilap warning that procurement laws do not allow spending beyond budget allocations.

This suggests that some of these repayments could have been manipulated to benefit a few individuals instead of serving the public interest.

Treasury officials defended themselves by blaming fluctuating exchange rates for the inconsistencies.

However, this explanation does little to address the core issue of why such a large sum remains unaccounted for.

Proper financial planning should anticipate currency fluctuations, and such a defense only raises more questions about the Treasury’s commitment to accountability.

Further complicating matters, the audit found that out of 32 loans examined, only 18 had feasibility studies conducted before borrowing.

This means that nearly half of the loans were taken without proper assessment of their necessity or impact on the economy.

In addition, 22 loans had no public participation documentation, leaving taxpayers in the dark about how their money was being spent. This lack of transparency is a violation of basic public finance principles.

The audit also revealed a serious disregard for legal procedures. Only five of the loans examined had legal opinions from the Attorney General, raising concerns about their legitimacy.

This failure to follow due process means that some of these loans could have been acquired illegally or under questionable terms, further exposing the country to financial risks.

Without proper legal backing, Kenya could be paying for loans that should never have been approved in the first place.These revelations come at a time when President William Ruto’s administration is already under pressure due to economic challenges and public frustration over increasing debt.

The latest findings add to growing fears that Kenya’s debt crisis is worsening due to mismanagement rather than necessity.

Treasury CS John Mbadi now faces the difficult task of explaining how such massive financial gaps occurred under his watch.

As Parliament intensifies its probe, public confidence in the government’s handling of public funds continues to erode.The issue is not just about missing funds but also about the wider culture of impunity in financial management. If no action is taken, Kenyans may continue to suffer from increasing taxation and deteriorating public services while a few individuals benefit from questionable financial dealings.

This scandal could have serious political consequences if those responsible are not held accountable. The question remains whether the government will take decisive action to clean up the mess or if this will be another case of corruption swept under the rug.

Leave feedback about this