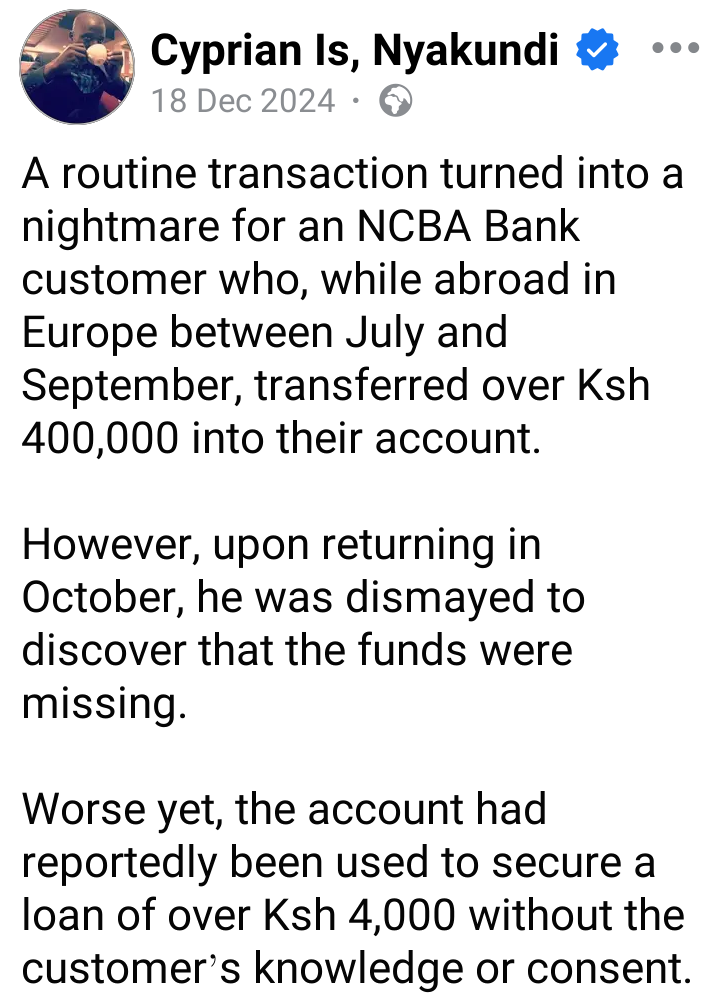

Cyprian Is Nyakundi, known for exposing corporate wrongdoings, had once shared a disturbing story that put NCBA Bank on the spotlight. A customer had been abroad in Europe between July and September during that year and decided to deposit over Ksh 400,000 into their NCBA account.

It was supposed to be a normal, secure transaction. However, when the customer returned to Kenya in October, they were shocked to find that their account balance was zero. The money had vanished without any explanation.

To make matters worse, the same account had been used to secure a loan of over Ksh 4,000 something the customer never applied for and didn’t authorize.

This raised serious questions about how NCBA was managing customer accounts and what kind of security protocols were in place.

For a major financial institution, allowing this kind of unauthorized activity is both unacceptable and dangerous.The customer reached out to NCBA expecting answers, but instead got vague responses.

The bank told them an investigation would be launched. But weeks and months passed, and the customer never received any solid explanation or solution.

They were left in the dark, frustrated and helpless, while their hard-earned money remained missing.This incident may have happened some time ago, but it still reflects the deep flaws within NCBA Bank’s operations.

There’s no excuse for a bank failing to protect deposits or allowing loans to be processed without proper identity verification. If one customer could go through this, how many others might have suffered silently or been ignored by the same system?

The fact that this customer had to turn to Cyprian Is Nyakundi to get their story heard shows just how poor NCBA’s customer service and internal accountability really were.

Instead of acting fast to resolve the issue, the bank chose to hide behind slow investigations and empty promises. It’s not just about one lost transaction, it’s about a bank showing little care for the people who trust it with their money.

Banks like NCBA should never get a free pass for failing to protect their clients. Incidents like this reveal a culture of negligence and raise the question, how safe is your money in such a bank? For NCBA, the damage may already be done, and trust once broken is very hard to rebuild.