NCBA Bank has come under fire for its poor customer service and questionable practices, particularly in how it handles card cancellations and CRB listings.

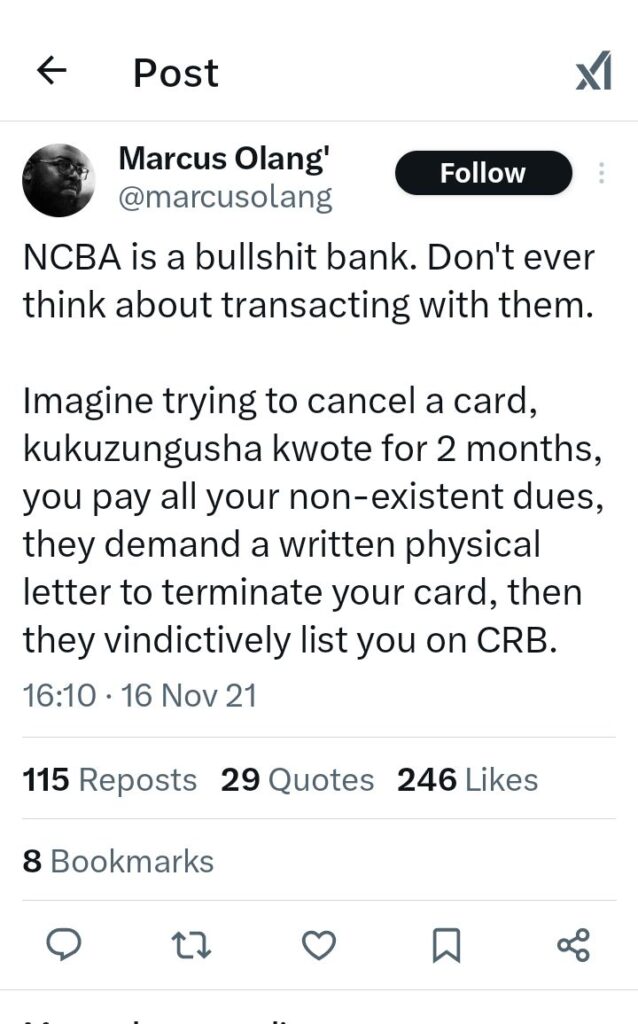

One frustrated customer detailed a two-month ordeal trying to cancel a card, during which they settled all their dues, only to face demands for a written letter to complete the process.

Despite complying, they were later listed on the Credit Reference Bureau (CRB), potentially damaging their creditworthiness.

This is not an isolated case. Social media is flooded with complaints about NCBA’s unreliable services.

In September 2020, customers reported issues with the bank’s online platform and criticized the lack of effective customer support.

Despite promises to address system challenges, these problems persisted, leaving many users stranded.

In another troubling incident, NCBA was accused of wrongful CRB listing.

In 2022, lawyer Philip Murgor threatened legal action after the bank listed him as a defaulter for a disputed Fuliza loan of just KSh 1,300.

Murgor stated that the bank failed to verify the claim, which not only damaged his reputation but also disrupted his business operations.

There are also accusations of NCBA engaging in practices that prioritize profit over transparency.

Many customers have reported hidden fees and inflated charges for basic services, which create unnecessary financial strain.

These allegations have raised serious concerns about the bank’s ethics and commitment to fairness.

Adding to the criticism are suspicions about the bank’s ties to powerful political families and allegations of involvement in money laundering.

Such claims further damage public trust and raise doubts about the institution’s integrity and management practices.

Given these issues, many customers are now looking for more reliable and transparent alternatives.

The Kenya Bankers Association offers a platform for reporting grievances, providing an avenue for accountability.

While NCBA remains a major player in Kenya’s banking sector, its reputation is at risk.

Incidents like mishandled card cancellations, unwarranted CRB listings, and unexplained fees have driven a wedge between the bank and its customers.

To regain trust, NCBA must prioritize transparency, ethical practices, and genuine customer satisfaction. Without these reforms, the bank risks losing its standing in an increasingly competitive industry.