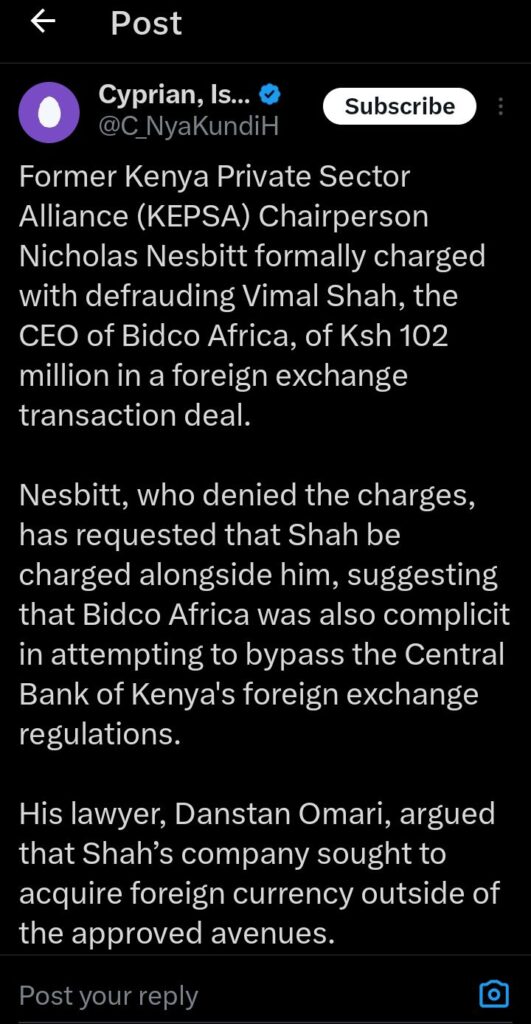

Cyprian Nyakundi recently shared on his X handle that Nicholas Nesbitt, the former Chairperson of the Kenya Private Sector Alliance (KEPSA), has been formally charged with defrauding Vimal Shah, the CEO of Bidco Africa, of Ksh 102 million.

This case revolves around a foreign exchange transaction deal that has raised attention due to the high-profile individuals involved.

Nesbitt, who has denied the charges, has made a surprising request, asking that Vimal Shah also be charged alongside him.

According to Nesbitt, Bidco Africa was complicit in attempting to bypass the Central Bank of Kenya’s foreign exchange regulations, which adds a layer of complexity to the case.

Nesbitt’s lawyer, Danstan Omari, has argued that Bidco Africa, under Shah’s leadership, sought to acquire foreign currency through unauthorized channels.

This claim suggests that the transaction in question was not conducted through the approved avenues, potentially violating the Central Bank of Kenya’s regulations.

Omari’s argument implies that both parties may have been involved in activities that contravene the law, and he is pushing for Shah to face similar legal scrutiny.

This development has sparked a debate about the integrity of foreign exchange transactions among Kenya’s corporate elite and whether such practices are more widespread than previously thought.

The court is expected to rule on Nesbitt’s bail application later today, a decision that will be closely watched by many.

If Nesbitt is granted bail, it could set a precedent for how similar cases are handled in the future, especially those involving high-profile business figures.

On the other hand, if bail is denied, it could signal a tougher stance by the judiciary on financial crimes, particularly those involving large sums of money and potential regulatory breaches.

The outcome of this case could have far-reaching implications for Kenya’s business community, as it may lead to increased scrutiny of foreign exchange transactions and corporate dealings.

Cyprian Nyakundi’s post has brought this case into the public eye, highlighting the ongoing legal battle between two prominent figures in Kenya’s private sector.

It will be interesting to see how the court deals the allegations and counter-allegations, and whether this will lead to reforms in how foreign exchange transactions are regulated in Kenya.

Leave feedback about this