In November 2024, former Law Society of Kenya President Nelson Havi made serious allegations against NCBA Bank, accusing it of privacy breaches and political witch-hunting.

Havi claimed that the bank unlawfully accessed his account information at the request of former President Uhuru Kenyatta.

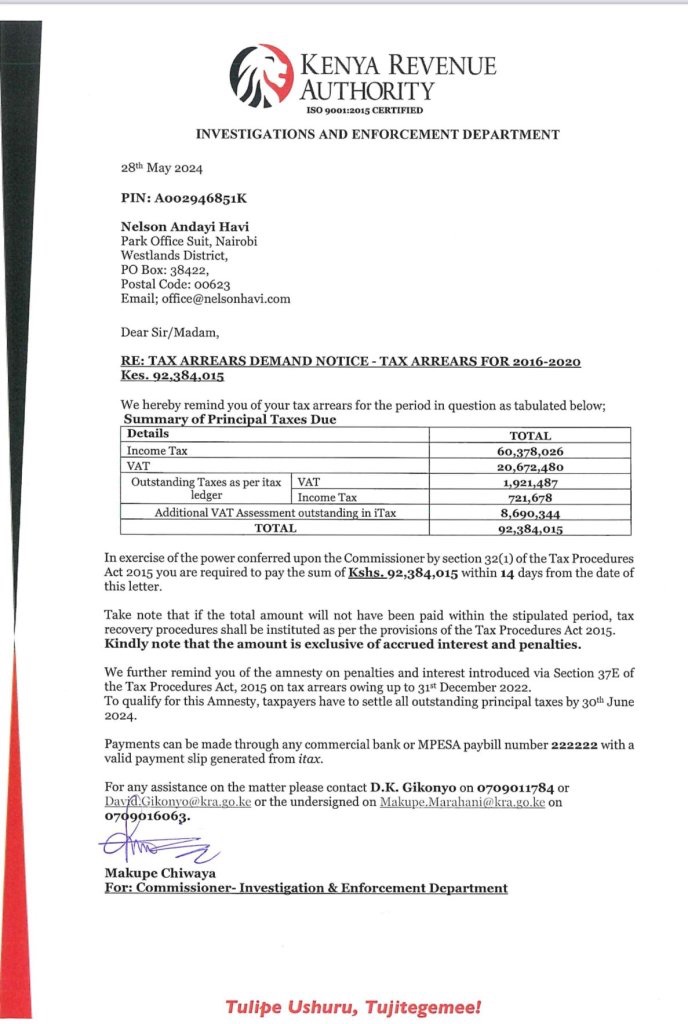

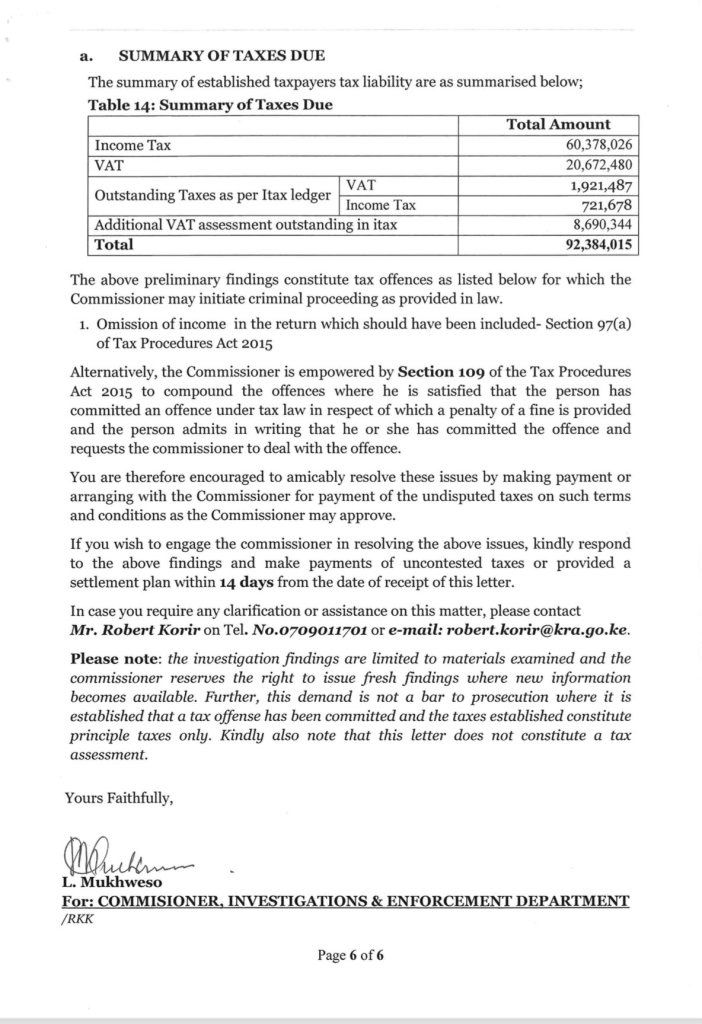

According to Havi, this breach of privacy was part of a broader political scheme that led to the Kenya Revenue Authority (KRA) launching tax investigations against him.

He suggested that the bank played a crucial role by providing his private banking details to facilitate these investigations.

Additionally, Havi claimed that the KRA denied him a Tax Compliance Certificate for 2020 based on instructions from President Kenyatta, despite him meeting all his tax obligations.

In response to these allegations, NCBA Bank’s Managing Director, John Gachora, confirmed that the bank had benefited from a Ksh.350 million tax waiver during its 2019 merger with NIC Group PLC and Commercial Bank of Africa (CBA).

Gachora acknowledged the waiver but assured the public that if the court found the bank was not entitled to it, they would pay the amount without delay.

He emphasized that this Ksh.350 million was a small portion of the billions in taxes the bank regularly pays and pointed out that NCBA Bank contributes to the country’s national tax revenue.

These events have stirred concerns about the bank’s internal practices and its involvement in political affairs.

The accusations of unlawfully sharing private customer information for political purposes have raised serious questions about the integrity and ethical standards of the bank.

This situation highlights a potential misuse of banking privileges and the need for financial institutions to remain neutral and independent from political influence.

The case has drawn attention to the necessity of strict privacy safeguards to protect customers and the importance of transparency in the operations of financial institutions.

The allegations have also brought attention to the relationship between banks and political figures, calling for greater accountability in how banks interact with political powers.

This incident serves as a reminder of the importance of protecting individuals’ privacy and ensuring that financial institutions follow legal and ethical guidelines without succumbing to political pressures.

Leave feedback about this